In Nigeria, consumers find themselves amidst a tumultuous economic landscape shaped by the erratic nature of government policies. The inconsistency in economic policies implemented by the Nigerian government has plunged consumers into a state of disarray, profoundly impacting their daily lives and financial stability.

In addition, inconsistent economic policies in Nigeria have a direct and significant impact on consumers, affecting various aspects of their daily lives and financial well-being. Here’s a detailed discussion on how these policies impact consumers:

Uncertainty and Investment:

Inconsistent policies create an atmosphere of uncertainty, which deters both domestic and foreign investments. This uncertainty can lead to reduced job opportunities, stagnant wages, and overall economic instability, directly impacting consumers’ purchasing power and financial security.

Inflation and Cost of Living:

Fluctuating policies often contribute to inflationary pressures. When policies change frequently or unexpectedly, it disrupts supply chains, increases production costs, and ultimately leads to higher prices for goods and services. This rise in the cost of living erodes consumers’ disposable income and diminishes their ability to afford essential items.

Currency Fluctuations

Changes in economic policies can also lead to currency fluctuations, affecting the value of the Nigerian Naira. Depreciation can make imports more expensive, further contributing to inflation and increasing the prices of imported goods, including fuel, food items, and consumer electronics.

Impact on Business and Consumer Confidence

Businesses rely on stable economic policies to make long-term decisions and investments. Inconsistent policies undermine business confidence, leading to reduced productivity and employment opportunities. This lack of confidence also spills over to consumers, who may become cautious about spending due to economic uncertainty.

Examples and Statistics

According to the National Bureau of Statistics (NBS), Nigeria’s inflation rate rose to 33.69% in April 2024 compared to March 2024 headline inflation rate which was 33.20% driven partly by inconsistent economic policies affecting food and energy prices.

The depreciation of the Naira against major currencies due to policy uncertainties has led to higher import costs, reflected in increased prices of goods such as rice, cooking oil, and electronics.

Businesses in sectors like agriculture and manufacturing often face challenges due to policy flip-flops, impacting their ability to expand operations and create jobs, thereby affecting consumer spending power.

It is important to note that, policy changes in Nigeria have had profound effects on both the manufacturing and agricultural sectors, significantly impacting consumers through various mechanisms:

Manufacturing Sector

Policy Influence

Changes in economic policies, such as tariffs, taxation, and import/export regulations, directly affect manufacturing industries. For instance, sudden tariff adjustments can increase the cost of importing raw materials or machinery, impacting production costs.

Impact on Consumers

Higher production costs often translate into increased prices for manufactured goods such as household items, electronics, and vehicles. This inflationary pressure reduces consumers’ purchasing power, limiting their ability to afford essential and non-essential goods alike.

Agricultural Sector

Policy Influence

Agricultural policies related to subsidies, land use regulations, and access to credit and technology significantly impact farmers’ productivity and profitability. Changes in these policies can either support or hinder agricultural production.

Impact on Consumers

Fluctuations in agricultural output due to policy changes affect food availability and prices. For example, reductions in subsidies for fertilizers or irrigation can decrease crop yields, leading to shortages and higher prices for staple foods like rice, maize, and vegetables. These price increases directly affect consumers’ food budgets and overall cost of living.

Supply Chain Disruptions:

Policy Influence

Inconsistent policies disrupt supply chains in both sectors. For instance, changes in trade policies or export restrictions can disrupt the flow of raw materials or agricultural products to manufacturing industries, leading to production delays or cost increases.

Impact on Consumers

Supply chain disruptions can result in sporadic availability of goods and services in the market. Consumers may experience shortages of certain products or face higher prices due to increased transportation costs or scarcity of raw materials.

Employment and Income Effects:

Policy Influence

Policies that affect the profitability and growth of these sectors also impact employment levels. Uncertain policies may discourage investments in new manufacturing facilities or agricultural projects, limiting job creation.

Impact on Consumers

Reduced employment opportunities or stagnant wages due to policy uncertainties affect consumers’ disposable income and overall economic stability. This can lead to decreased consumer spending and slower economic growth.

Examples and Statistics

During periods of policy uncertainty or sudden changes, manufacturing companies may delay expansion plans or investments in new technology, impacting their ability to innovate and meet consumer demand.

In agriculture, changes in land use policies or subsidies can influence crop choices and farming practices, affecting both production levels and food prices.

In summary, policy changes in Nigeria significantly influence the manufacturing and agricultural sectors, which in turn affect consumers through increased prices, supply chain disruptions, and employment effects. Stable and predictable policies are crucial to fostering growth in these sectors and ensuring consumer welfare by maintaining affordability and availability of essential goods and services.

Also, Nigerian consumers are responding to the challenges posed by inconsistent economic policies in several adaptive ways:

Adjusting Spending Habits

Many consumers are adapting by altering their spending patterns. They may prioritize essential goods and reduce discretionary spending on non-essential items. Consumers are also becoming more price-sensitive, opting for cheaper alternatives or shopping at lower-cost stores to stretch their budgets further.

Increasing Reliance on Informal Markets

With fluctuating prices and shortages in formal markets, consumers are increasingly turning to informal markets and local vendors.Informal markets often offer more stable prices and a wider range of goods, albeit with varying quality and reliability.

Seeking Alternative Income Sources

In response to economic uncertainties, some consumers are diversifying their income streams. This includes engaging in part-time jobs, freelance work, or small-scale entrepreneurship to supplement their primary income.

Saving and Investment Strategies

Recognizing the volatility in prices and economic conditions, consumers are prioritizing savings. They are setting aside funds as a buffer against future uncertainties and emergencies.

Some are exploring investment opportunities that offer potential returns higher than inflation rates, although this requires navigating risks associated with market instability.

Advocacy and Civic Engagement

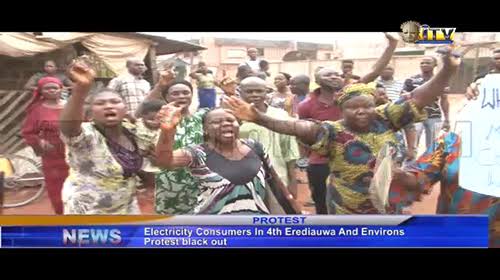

In response to policy changes affecting consumer welfare, advocacy groups and consumer rights organizations are becoming more vocal. They engage in public awareness campaigns, lobby policymakers, and advocate for policies that promote consumer interests and economic stability.

Adapting to Technological Solutions

The rise of digital platforms and e-commerce has provided consumers with more options for shopping and accessing goods and services. Online shopping allows consumers to compare prices easily and find discounts, mitigating the impact of inflation in physical stores.

Community Support and Mutual Aid

Communities are coming together to support vulnerable groups and share resources. This includes initiatives such as community gardens, food banks, and neighborhood cooperatives aimed at ensuring access to affordable food and essential goods.

Overall, Nigerian consumers are demonstrating resilience and adaptability in the face of economic challenges caused by inconsistent policies. Their responses underscore the importance of flexibility, resourcefulness, and community support in navigating uncertain economic environments while striving to maintain their livelihoods and quality of life.

Coping mechanisms

Nigerian consumers employ various coping mechanisms to mitigate the effects of inconsistent economic policies, adapting their strategies to navigate uncertain and volatile conditions:

Changes in Spending Habits:

Prioritizing Essential Purchases

Consumers prioritize spending on essential goods such as food, healthcare, and education. Non-essential purchases are reduced or postponed to conserve financial resources.

Budgeting and Financial Planning

Many consumers create strict budgets to manage their income effectively. This includes allocating specific amounts for different expenses and setting savings goals to build financial resilience.

Reliance on Informal Markets:

Seeking Stability in Prices

Due to fluctuating prices in formal markets, consumers increasingly rely on informal markets and local vendors. These markets often offer more stable prices and a wider variety of goods, helping consumers manage their household budgets more predictably.

Bartering and Direct Transactions

In some cases, consumers engage in bartering or direct transactions with producers or traders in informal settings, bypassing formal market channels affected by policy-induced price fluctuations.

Savings and Investments:

Creating Financial Buffers

Aware of economic uncertainties, consumers prioritize savings as a buffer against unexpected expenses and income disruptions. They aim to build emergency funds to cushion the impact of inflation and economic downturns.

Exploring Investment Opportunities

Some consumers seek investment opportunities that offer potential returns higher than inflation rates. This includes investments in real estate, agriculture, or small businesses, albeit with careful consideration of associated risks.

Diversification of Income Sources:

Part-Time Work and Freelancing

To supplement their primary income, consumers explore part-time jobs, freelance work, or online gigs. This diversification helps mitigate the impact of job losses or reduced wages resulting from economic uncertainties.

Entrepreneurship

Some consumers venture into small-scale entrepreneurship, leveraging skills and resources to establish micro-enterprises or side businesses. This provides additional income streams and reduces dependence on volatile employment sectors.

Community Support and Mutual Aid:

Pooling Resources

Communities organize mutual aid initiatives, such as community gardens, food banks, or savings groups. These initiatives help ensure access to affordable food and essential goods, fostering resilience and solidarity among community members.

Advocacy and Collective Action

Consumer advocacy groups and community organizations advocate for policies that safeguard consumer rights and promote economic stability. They engage in lobbying efforts and public campaigns to raise awareness of issues affecting consumers.

Utilization of Technology:

Digital Platforms and E-commerce

The proliferation of digital platforms and e-commerce enables consumers to compare prices, find discounts, and access a wider range of products. Online shopping offers convenience and cost-effectiveness, mitigating the impact of inflation in physical stores.

These coping mechanisms highlight Nigerian consumers’ resilience and resourcefulness in adapting to economic challenges induced by inconsistent policies. By diversifying income sources, prioritizing essential expenditures, and leveraging community support and technological innovations, consumers strive to maintain financial stability and improve their quality of life amidst uncertain economic conditions.

The impact of inconsistent economic policies on Nigerian consumers is profound and multi-faceted, influencing various aspects of their daily lives and financial stability:

Financial Instability

Inconsistent policies contribute to economic uncertainty, affecting consumers’ ability to predict prices and plan expenditures. This instability reduces consumer confidence and limits spending on non-essential items.

Inflationary Pressure

Policy fluctuations lead to inflation, causing prices of essential goods and services to rise. This increase in the cost of living diminishes consumers’ purchasing power and necessitates adjustments in spending habits.

Currency Depreciation

Changes in economic policies often result in currency depreciation, impacting the value of the Nigerian Naira. This depreciation makes imported goods more expensive, further contributing to inflation and increasing the cost of living for consumers.

Sector-specific Impacts

The manufacturing and agricultural sectors are particularly affected by policy changes, influencing production costs, supply chain stability, and employment levels. These impacts trickle down to consumers through higher prices and reduced availability of goods.

Adaptive Strategies

Nigerian consumers respond to these challenges by adjusting their spending habits, relying on informal markets for stable prices, diversifying income sources through savings and investments, and leveraging community support and technological advancements to mitigate the effects of inconsistent policies.

In conclusion, the detrimental effects of inconsistent economic policies on Nigerian consumers underscore the importance of stable and predictable policy frameworks. Ensuring policy coherence is crucial for fostering economic stability, safeguarding consumer welfare, and promoting sustainable growth in Nigeria’s economy.