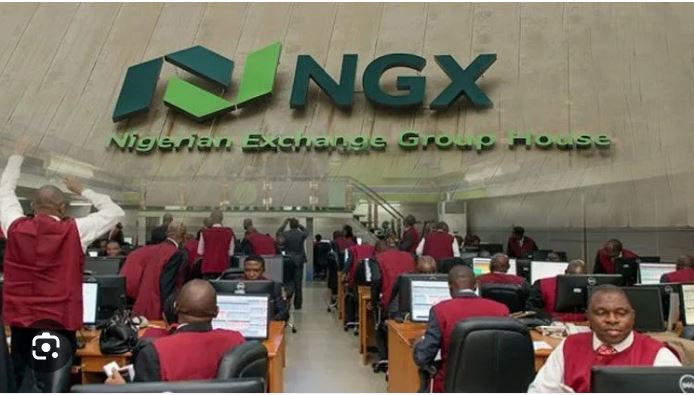

As we look ahead to the coming week, the performance of Nigerian stocks will likely be influenced by a combination of macroeconomic factors, corporate earnings reports, and investor sentiment. The Nigerian stock market, like many others globally, is sensitive to a range of domestic and international events that could sway market direction. Here’s a breakdown of the key factors that may impact the Nigerian Stock Exchange (NSE) in the next week.

Macroeconomic Environment

The continued devaluation of the naira and persistent inflation are critical factors that could weigh on investor sentiment. As inflationary pressures remain high, consumer purchasing power is being eroded, which could negatively impact companies in consumer-facing sectors such as fast-moving consumer goods (FMCG) and retail. Investors may shy away from these sectors in favor of those more resilient to inflation, such as the energy and telecommunications sectors.

Additionally, the ongoing challenges with fuel scarcity and its impact on transportation and logistics costs could further strain companies’ profitability, especially those reliant on extensive distribution networks. If these macroeconomic conditions worsen, we may see a pullback in stock prices, particularly in sectors most affected by these factors.

This week, the release of quarterly earnings reports from key companies will be a significant driver of stock market performance. Investors will closely scrutinize these reports to gauge how companies are managing the challenging economic environment. Strong earnings results could boost investor confidence and lead to upward movement in stock prices, particularly if companies report better-than-expected profits or announce positive forward guidance.

Conversely, disappointing earnings could trigger sell-offs, especially if companies report declining margins due to rising costs or if they signal weaker future performance. Sectors such as banking, telecommunications, and oil and gas will be in the spotlight, as their performance is often seen as a bellwether for the broader market.

Investor Sentiment and Foreign Participation

Investor sentiment, both domestic and foreign, will play a crucial role in determining market direction. The Nigerian stock market has seen fluctuating levels of foreign investor participation, largely influenced by the naira’s stability and the country’s foreign exchange policies. If there is a perception that the naira may continue to depreciate or that accessing foreign exchange will remain difficult, foreign investors might reduce their exposure to Nigerian equities, leading to downward pressure on the market.

Domestically, investors may remain cautious given the current economic challenges. However, if there is any positive news regarding government policies, such as reforms aimed at stabilizing the currency or improving the business environment, we could see a renewed interest in equities, driving prices higher.

Global Market Trends

Global market trends will also influence Nigerian stocks, especially in a week where major global economic data releases or central bank announcements are expected. For example, if there are significant developments regarding interest rates from the U.S. Federal Reserve or the European Central Bank, we could see ripple effects in emerging markets, including Nigeria.

Commodity prices, particularly oil, will be another critical factor. Nigeria’s economy is heavily reliant on oil revenues, and fluctuations in global oil prices can impact the stock market, especially stocks in the oil and gas sector. A rise in oil prices could bolster stocks like Seplat and Oando, while a decline could have the opposite effect.

Technical Indicators

From a technical analysis perspective, the Nigerian stock market is currently in a consolidation phase, with key indices like the NSE All-Share Index hovering around critical support levels. If these support levels hold, we could see a technical rebound, particularly if there is any positive news flow or earnings surprises. On the other hand, a breakdown below these levels could trigger a sell-off, leading to a further decline in stock prices.

In summary, the performance of Nigerian stocks in the next week will likely be shaped by a combination of macroeconomic conditions, corporate earnings, investor sentiment, and global market trends. While there are opportunities for gains, particularly in resilient sectors, the overall outlook remains cautious. Investors are advised to keep a close eye on key economic indicators, earnings reports, and global developments as they navigate what promises to be a volatile week in the Nigerian stock market.